Military service is a demanding yet rewarding career path. While serving your country, financial security is a top priority. But what about generating income that flows even when you’re deployed or busy with training? Passive income can be a game-changer, allowing your money to work for you while you focus on your service. Here are some proven options to explore, along with step-by-step breakdowns and resources to get you started:

Investment Options

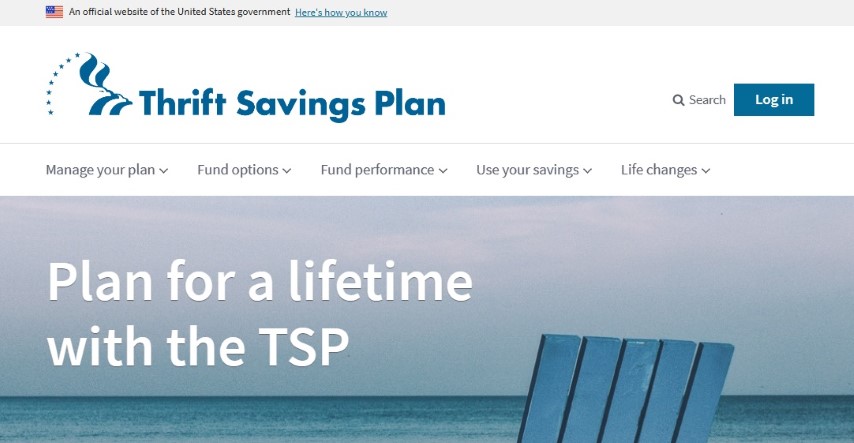

Military TSP (Thrift Savings Plan):

This is a low-cost, tax-advantaged retirement savings plan offered by the military. Similar to a civilian 401(k), it allows automatic contributions from your paycheck towards your future. The TSP offers a variety of low-cost index funds, allowing you to invest in a diversified portfolio for long-term growth.

Steps to Get Started:

- Enroll in the TSP through your military service branch’s online portal or by contacting your finance office.

- Choose your contribution amount. You can start small and gradually increase as your budget allows.

- Select your investment allocation. The TSP offers a variety of pre-made investment options based on your risk tolerance and target retirement date. You can also choose to build your own custom allocation.

Robo-advisors

These automated investment platforms are perfect for beginners. They use algorithms to create a diversified portfolio based on your risk tolerance and investment goals. You set up automatic deposits, and the platform handles the rest, rebalancing your portfolio as needed.

Steps to Get Started:

- Choose a robo-advisor platform that aligns with your needs and fees.

- Answer a questionnaire about your financial goals and risk tolerance.

- The platform will recommend a personalized investment portfolio.

- Fund your account and set up automatic deposits.

Popular Robo-advisors for Military Families:

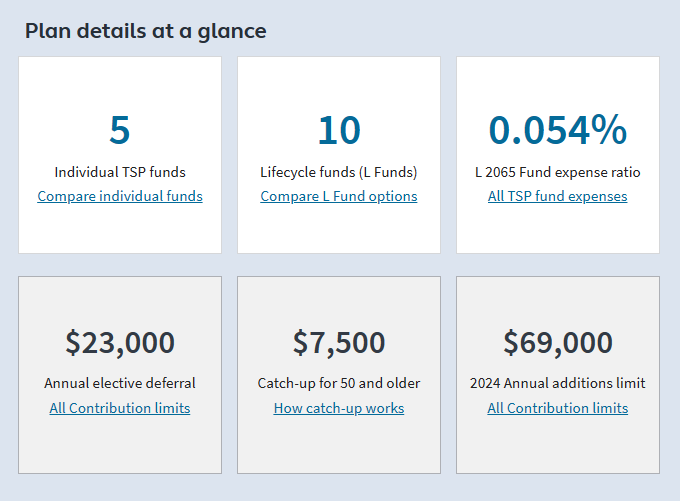

Schwab Intelligent Portfolios

Schwab Intelligent Portfolios: Schwab Offers a user-friendly interface and low fees.

Pros:

- User-friendly Interface: Schwab’s platform is easy to navigate, even for beginners.

- Low Fees: Schwab charges minimal advisory fees, making it a cost-effective option.

- Fractional Shares: Invest in expensive stocks with fractional shares, allowing you to diversify your portfolio even with limited funds.

- Tax-Optimization Tools: Schwab helps you minimize your tax burden through automatic tax-loss harvesting.

Cons:

- Limited Customization: While you can choose your asset allocation, customization options are somewhat limited compared to some competitors.

- Higher Minimum Investment: Schwab requires a $5,000 minimum investment to get started.

Who Should Invest: Schwab Intelligent Portfolios are a good fit for military service members who prioritize a user-friendly platform, low fees, and automated tax-optimization. This option might be ideal for those comfortable with a pre-built portfolio allocation but don’t require extensive customization.

Robin hood

Robin hood: Robinhood Another commission-free option with personalized investment strategies.

Pros:

- Commission-Free Trading: Robinhood is known for its commission-free stock and ETF trades, making it a cost-conscious choice.

- Fractional Shares: Similar to Schwab, Robinhood allows you to invest in fractional shares, increasing your portfolio diversification options.

- User-Friendly Mobile App: Manage your investments conveniently through Robinhood’s mobile app, perfect for on-the-go access.

Cons:

- Limited Robo-Advisor Services: Robinhood’s robo-advisor service, Robinhood Autopilot, is still relatively new and offers fewer features compared to established players.

- Limited Customer Support: Robinhood relies heavily on online resources for customer support, which might not be ideal for everyone.

- No Tax-Optimization Tools: Currently, Robinhood doesn’t offer automated tax-loss harvesting or other tax-optimization features.

Who Should Invest: Robinhood is a good option for cost-conscious investors comfortable with a self-directed approach and minimal robo-advisor features. This platform might be suitable for younger military service members who are tech-savvy and prioritize a mobile-first experience. However, it might not be ideal for those seeking extensive portfolio customization or automated tax-optimization tools.

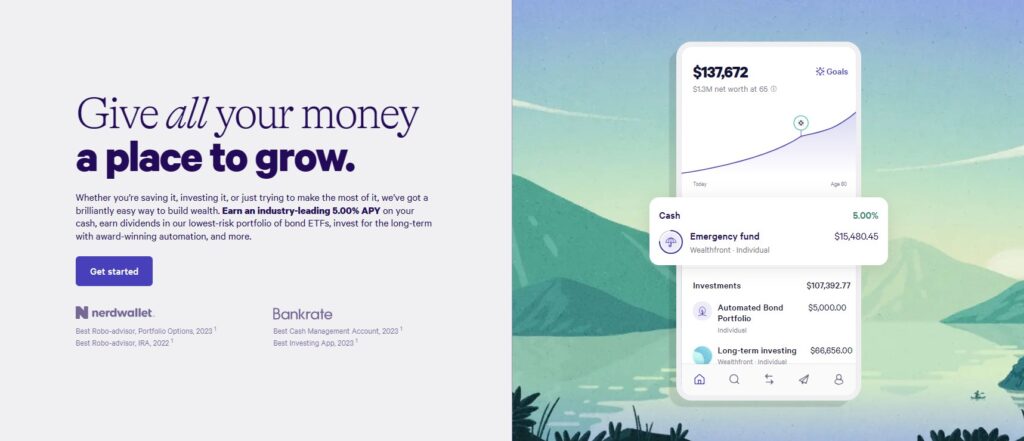

Wealthfront

Wealthfront: Wealthfront Known for its tax-optimization tools and low account minimums.

Pros:

- Tax-Optimization Tools: Wealthfront excels at tax-loss harvesting and other strategies to minimize your tax burden.

- Personalized Investment Strategies: Wealthfront offers a high level of customization, allowing you to tailor your portfolio allocation to your specific goals.

- Low Account Minimums: Start investing with as little as $500, making Wealthfront accessible to those just starting their investment journey.

Cons:

- Slightly Higher Fees: Wealthfront’s fees are slightly higher than some competitors, though still considered reasonable.

- No Fractional Shares: Currently, Wealthfront doesn’t offer fractional share investing, which can limit diversification options for smaller investment amounts.

Who Should Invest: Wealthfront is a great choice for military service members seeking a personalized investment strategy, automated tax-optimization, and a low minimum investment requirement. This platform might be ideal for those comfortable with slightly higher fees in exchange for a more hands-on approach to portfolio customization.

Real Estate

Owning rental properties can generate passive income through monthly rental payments. However, this option requires significant upfront capital, ongoing management responsibilities, and comes with inherent risks. Military service members stationed overseas may find real estate management particularly challenging.

Important Considerations:

- Military Restrictions: Active-duty military personnel may have restrictions on owning rental properties in certain locations. Always check with your branch’s ethics office before pursuing this option.

- Deployment and Training: Managing rental properties can be time-consuming. Consider hiring a property management company if deployments or training schedules become a factor.

Alternative Real Estate Investments for Military Service Members

Owning rental properties can be a tempting path to passive income. However, military service comes with unique challenges that can make traditional real estate ownership less than ideal. Frequent relocations, deployments, and the demands of military service can make property management a burden.

Luckily, there are alternative real estate investment options that offer exposure to the potential benefits of real estate without the hands-on hassles:

Real Estate Investment Trusts (REITs):

- Invest Like a Pro: REITs are companies that own and operate income-producing real estate properties like apartments, office buildings, or shopping centers. By investing in REITs, you gain exposure to the real estate market without the responsibilities of direct ownership.

Pros:

- Liquidity: REITs are traded on stock exchanges like other stocks, offering greater liquidity compared to directly owning properties. This allows you to easily buy and sell your shares as needed.

- Diversification: REITs often hold a portfolio of various properties across different locations and sectors, providing built-in diversification within your investment holdings.

- Passive Income: REITs typically distribute a portion of their rental income to shareholders as dividends, offering a potential stream of passive income.

Cons:

- Taxation: REIT dividends are subject to taxation, and unlike some traditional property ownership benefits, depreciation cannot be claimed.

- Market Fluctuations: REIT share prices can fluctuate like any stock, meaning your investment value can go up or down.

Start Exploring REITs:

National Association of Real Estate Investment Trusts (NAREIT)

National Association of Real Estate Investment Trusts (NAREIT): Provides educational resources and information on various REIT sectors. Offers investment research, news, and data on publicly traded REITs.

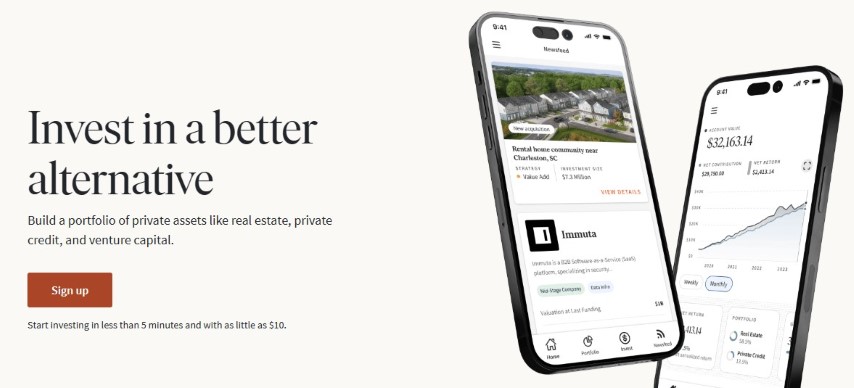

Real Estate Crowdfunding Platforms:

- Invest in a Piece of the Pie: Real estate crowdfunding platforms allow you to invest in commercial real estate projects with smaller investment amounts compared to traditional property ownership. These platforms pool funds from multiple investors to finance these projects.

Pros:

- Accessibility: Crowdfunding platforms offer lower investment minimums, making real estate investing more accessible compared to buying an entire property.

- Variety of Projects: Invest in a wider range of real estate projects across different sectors and geographic locations, spreading your risk and potentially increasing returns.

- Passive Management: The platform handles the property management aspects, freeing you from the day-to-day responsibilities of property ownership.

Cons:

- Newer Investment Option: Real estate crowdfunding is a relatively new investment option, and projects carry inherent risks. There’s a chance of losing your entire investment if the project fails.

- Limited Liquidity: Unlike publicly traded REITs, crowdfunding investments are typically illiquid. Selling your shares before the project’s completion can be difficult.

Explore Crowdfunding Platforms:

Fundrise

Fundrise: (https://fundrise.com/) One of the largest real estate crowdfunding platforms with a focus on commercial properties.

RealtyMogul

RealtyMogul: Another established platform offering debt and equity investment opportunities in various real estate sectors.

Real Estate Investment Groups:

- Pool Your Resources: Real estate investment groups allow you to pool your investment capital with others to purchase and manage income-producing properties. These groups often have experienced professionals handling property management and asset allocation.

Pros:

- Professional Management: Benefit from the expertise of experienced property managers within the group, ensuring your investments are well-maintained and tenanted.

- Shared Investment Decisions: Group decision-making can provide valuable insights and mitigate the risks associated with individual property selection.

- Reduced Investment Minimums: Similar to crowdfunding, groups often require lower capital contributions compared to buying property alone.

Cons:

- Management Fees and Profit Sharing: Management fees and profit-sharing structures can vary between groups. These fees can eat into your returns if not carefully considered.

- Limited Control: You may have less control over investment decisions compared to directly owning a property.

Finding Real Estate Investment Groups:

Local REIA Chapters (Real Estate Investor Associations)

Local REIA Chapters (Real Estate Investor Associations): Connect with local REIA chapters to network with other investors and potentially find investment groups.

Online Investment Forums

Online Investment Forums (BiggerPockets): Online forums like BiggerPockets offer communities where you can connect with experienced real estate investors and find out about investment groups.

Online Options

Affiliate Marketing

This strategy involves promoting other companies’ products or services through unique affiliate links. You earn a commission whenever someone makes a purchase through your link. Successful affiliate marketing requires creating high-quality content like blog posts, videos, or social media posts that attract an audience interested in the products or services you promote. you can also check How to make money through Affiliate marketing guide.

Steps to Get Started:

- Find Your Niche: Choose a topic you’re passionate about and has affiliate programs available.

- Choose Your Platform: Build a website, blog, or leverage social media platforms to reach your audience.

- Join Affiliate Programs: Research and join reputable affiliate programs in your niche.

- Create Engaging Content: Promote affiliate products organically within your content, focusing on value and providing honest reviews.

Affiliate Marketing Resources:

- ClickHustle.net: Click Hustle have great recourse to get started with Affiliate Marketing. You can start from and can learn affiliate marketing.

- Affiliate Network Directory: Finds affiliate programs across various niches.

- The Affiliate Guy: Offers free and paid resources for affiliate marketers.

- Create and Sell Online Courses: If you have a particular skill or knowledge set, you can create and sell online courses. Platforms like Udemy or Skillshare allow you to upload.

Conclusion

Military service is a noble career path, but financial security is equally important. Passive income streams can provide a financial safety net and allow your money to work for you, even when deployments or training disrupt your schedule. This article explored various options for military service members to consider, from investment opportunities like the Thrift Savings Plan and robo-advisors to online ventures like affiliate marketing and creating online courses.

Remember, building passive income takes time and effort. Choose options that align with your interests and skills, prioritize your military service commitments, and conduct thorough research before investing. With dedication and the right strategy, you can establish a passive income stream that supports your financial goals and future.

Pingback: trucking automation passive income - ClickHustle.net

Pingback: Passive Income for Freelancer - ClickHustle.net

Pingback: Passive Income from Land - ClickHustle.net

Pingback: Passive Income for Dentists - ClickHustle.net

Pingback: 5 Best Passive Income Apps to Earn Extra Money - ClickHustle.net